Pakistan’s economy has faced significant challenges over the past several decades, transforming from one of South Asia’s strongest economies to one of its most vulnerable. This comprehensive guide examines the multifaceted economic issues plaguing Pakistan, from governance failures and mounting debt to climate disasters and energy shortages. Understanding these challenges is crucial for policymakers, businesses, and citizens alike as the country navigates its path toward economic stability and growth.

Once considered an economic success story in the region, Pakistan has experienced declining growth rates, persistent inflation, mounting debt, and recurring balance of payment crises. These challenges have been compounded by governance issues, political instability, and external shocks like the COVID-19 pandemic and devastating floods. This guide provides an in-depth analysis of these issues while exploring potential pathways to economic recovery and sustainable development.

Stay Informed About Pakistan’s Economy

Subscribe to our newsletter for regular updates on Pakistan’s economic developments, policy changes, and analysis from leading economists.

Governance and Corruption Problems

Governance failures and corruption have been persistent obstacles to Pakistan’s economic development. The country has struggled with institutional weaknesses that undermine policy implementation and create an unfavorable business environment. According to Transparency International, Pakistan ranked 140th out of 180 countries in the 2023 Corruption Perceptions Index, highlighting the severity of the problem.

Impact of Poor Governance on Economic Performance

Poor governance has directly contributed to Pakistan’s economic underperformance in several ways:

The World Bank’s Governance Indicators show Pakistan performing poorly across all dimensions, including government effectiveness, regulatory quality, rule of law, and control of corruption. These governance deficiencies have created an environment where economic reforms are difficult to implement and sustain.

State-Owned Enterprises: A Drain on Resources

Pakistan’s state-owned enterprises (SOEs) represent a significant governance challenge. Many operate at substantial losses, requiring continuous government subsidies that strain the national budget. The inefficient management of these enterprises diverts resources from critical development needs and contributes to the fiscal deficit.

Privatization efforts have been inconsistent and often politically contentious. Successive governments have announced ambitious privatization plans, but implementation has been limited due to political resistance, labor union opposition, and concerns about transparency in the privatization process.

“Pakistan’s governance challenges represent a fundamental constraint to economic growth. Without addressing these institutional weaknesses, sustainable economic development will remain elusive.”

Addressing governance and corruption issues requires comprehensive reforms, including strengthening accountability mechanisms, enhancing transparency in public procurement, improving the regulatory framework, and building the capacity of key institutions. These reforms are essential for creating an environment conducive to economic growth and development.

Climate Change Impacts on the Economy

Pakistan ranks among the world’s most climate-vulnerable countries despite contributing less than 1% to global greenhouse gas emissions. The economic consequences of climate change have become increasingly severe, with extreme weather events causing widespread destruction and disrupting economic activities.

The 2022 Floods: A Case Study in Climate Vulnerability

The catastrophic floods of 2022 provide a stark illustration of Pakistan’s climate vulnerability. These floods affected over 33 million people and caused economic losses estimated at $30-40 billion. Key impacts included:

The floods exacerbated existing economic challenges, pushing inflation higher and straining government finances as resources were diverted to relief and reconstruction efforts.

Agricultural Vulnerability and Food Security

Agriculture, which accounts for about 23% of Pakistan’s GDP and employs around 37% of the labor force, is particularly vulnerable to climate change. Changing precipitation patterns, increasing temperatures, and more frequent extreme weather events threaten agricultural productivity and food security.

Climate change is affecting Pakistan’s agricultural sector through:

Direct Impacts

Economic Consequences

Water Stress and Energy Production

Pakistan is already a water-stressed country, and climate change is exacerbating this challenge. Changing precipitation patterns and accelerated glacial melt in the Himalayas are affecting water availability for agriculture, industry, and hydropower generation. The economic implications include reduced agricultural output, constraints on industrial production, and challenges for energy security.

Climate adaptation and resilience-building require significant investments in infrastructure, technology, and capacity building. However, Pakistan’s fiscal constraints limit its ability to make these investments, creating a challenging cycle where climate vulnerability further undermines economic stability.

Download Our Climate Impact Report

Get our detailed analysis of climate change impacts on Pakistan’s economy and recommendations for building resilience.

Inflation and Cost of Living Crisis

Pakistan has experienced persistent high inflation, which reached a peak of nearly 38% in May 2023—the highest rate in almost 50 years. This severe inflation has created a cost of living crisis that disproportionately affects lower and middle-income households.

Drivers of Inflation in Pakistan

Multiple factors have contributed to Pakistan’s high inflation rates:

Food Inflation and Its Social Impact

Food inflation has been particularly severe, with rates exceeding 45% in 2023. This has had profound social implications, including:

Economic Impacts

Social Consequences

The government has implemented various measures to address inflation, including monetary tightening through interest rate hikes, targeted subsidies for essential items, and price control mechanisms. However, these measures have had limited effectiveness due to structural economic challenges and external factors.

Key Statistic: In 2023, the average Pakistani household was spending approximately 50-60% of its income on food, compared to the global average of 30-35%, highlighting the severity of the cost of living crisis.

Recent data shows inflation moderating to single digits by early 2025, providing some relief to consumers. However, the economic damage caused by the prolonged period of high inflation continues to affect household finances and business confidence.

Public Debt and External Borrowing Pressure

Pakistan’s public debt burden has reached alarming levels, constraining fiscal space and threatening economic stability. As of mid-2024, public and publicly guaranteed debt amounted to approximately 75% of GDP, with around 40% denominated in foreign currencies.

The Debt Trap: How Pakistan Got Here

Several factors have contributed to Pakistan’s debt accumulation:

The Interest Burden: Crowding Out Development

The most concerning aspect of Pakistan’s debt situation is the enormous interest burden it creates. Interest payments have reached approximately 60% of government revenue—one of the highest ratios globally. This means that for every rupee the government collects, 60 paisa goes toward interest payments, leaving little for development expenditures, social services, or infrastructure investment.

“Pakistan’s interest-to-revenue ratio of 60% is unsustainable, both fiscally and from a social stability perspective. International experience suggests that ratios above 25% are difficult to maintain over extended periods.”

External Debt Challenges and IMF Programs

Pakistan’s external debt presents particular challenges due to the country’s limited foreign exchange reserves. As of 2024, Pakistan faces external debt repayments of $14-20 billion annually over the next five years, while foreign exchange reserves have fluctuated between $4-12 billion—often providing only a few months of import cover.

To address these challenges, Pakistan has repeatedly turned to the International Monetary Fund (IMF). The most recent program, a 37-month Extended Fund Facility (EFF) agreed in September 2024, aims to stabilize the economy through fiscal consolidation, structural reforms, and external support. Key elements include:

While the IMF program has helped stabilize the immediate crisis, concerns remain about the sustainability of Pakistan’s debt in the medium to long term. The high interest burden, limited fiscal space, and challenging external environment create significant risks.

Understand Pakistan’s Debt Dynamics

Get our expert analysis on Pakistan’s debt sustainability and future economic prospects.

Unemployment and Weak Job Market

Pakistan faces significant employment challenges, with a large and growing youth population entering a job market that struggles to create sufficient quality employment opportunities. Official unemployment statistics, which hover around 6-8%, mask the reality of widespread underemployment, informal work, and discouraged job seekers.

Demographic Challenge: Youth Bulge

Pakistan’s demographic structure presents both an opportunity and a challenge. With approximately 64% of the population under the age of 30, the country could benefit from a demographic dividend if these young people can be productively employed. However, the economy has not generated enough jobs to absorb the 2-2.5 million young people entering the labor market annually.

Structural Issues in the Labor Market

Several structural factors contribute to Pakistan’s employment challenges:

Supply-Side Issues

Demand-Side Issues

Informal Economy and Underemployment

The informal sector accounts for approximately 70% of non-agricultural employment in Pakistan. While this provides livelihoods for millions, informal work typically offers lower wages, fewer benefits, and less job security. Many workers are underemployed, working fewer hours than desired or in positions that don’t fully utilize their skills and education.

Key Statistic: Graduate unemployment in Pakistan is estimated at 16.5%, more than double the overall unemployment rate, highlighting the disconnect between higher education and job market opportunities.

The COVID-19 pandemic and subsequent economic challenges have further strained the job market. The International Labour Organization estimated that the pandemic caused job losses or income reductions for approximately 12.5 million workers in Pakistan, with informal workers particularly affected.

Addressing unemployment requires a multi-faceted approach, including investments in education and skills development, policies to promote labor-intensive sectors, improvements in the business environment, and measures to increase female labor force participation. Without significant progress in job creation, Pakistan risks social instability and wasted human potential.

Energy Crisis and Circular Debt

Pakistan’s persistent energy crisis has been a major constraint on economic growth and development. Power shortages, high electricity costs, and the accumulation of circular debt in the energy sector have undermined industrial competitiveness and deterred investment.

Understanding Pakistan’s Energy Challenges

The energy sector faces multiple interconnected challenges:

The Circular Debt Problem

One of the most persistent challenges in Pakistan’s energy sector is circular debt—a cascading chain of unpaid bills that begins with consumers and distribution companies and extends to generation companies, fuel suppliers, and ultimately the government. As of 2024, circular debt in the power sector had reached approximately 4% of GDP.

The circular debt cycle operates as follows:

This cycle creates operational inefficiencies, deters investment in the sector, and diverts government resources from other priorities. Despite multiple attempts at reform, the circular debt problem has persisted and grown over time.

Economic Impact of Energy Shortages

The energy crisis has had far-reaching economic consequences:

Industrial Impact

Broader Economic Effects

Recent reforms have focused on improving the energy mix through increased renewable energy capacity, enhancing collection efficiency, reducing theft, and adjusting tariffs to better reflect costs. While these measures have shown some promise, comprehensive reform of the energy sector remains a critical challenge for Pakistan’s economic future.

“The energy sector’s challenges represent one of the most significant constraints on Pakistan’s economic growth potential. Resolving these issues is essential for sustainable development.”

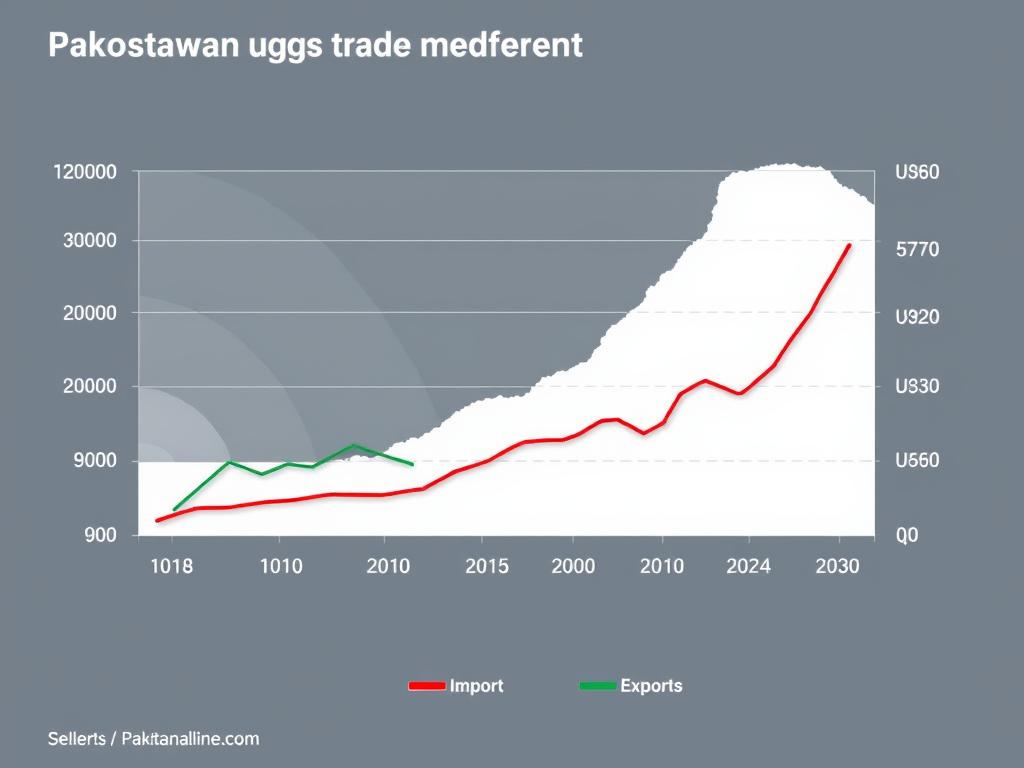

Trade Deficit and Export Weakness

Pakistan has struggled with persistent trade deficits, with imports consistently exceeding exports by a significant margin. This imbalance has contributed to balance of payments pressures, currency depreciation, and reliance on external borrowing.

Export Performance and Challenges

Pakistan’s export base remains narrow and concentrated in low-value-added products. Textiles and clothing account for approximately 60% of merchandise exports, making the export sector vulnerable to sector-specific shocks and competitive pressures.

Import Dependency and Vulnerability

Pakistan’s import profile reflects significant dependency on essential items that are difficult to substitute domestically:

Critical Import Categories

Economic Vulnerabilities

During periods of external pressure, Pakistan has often resorted to import restrictions and administrative measures to contain the trade deficit. While these measures provide temporary relief, they disrupt supply chains, create shortages, and ultimately undermine economic growth.

Exchange Rate Policy and Trade Balance

Pakistan’s historical preference for maintaining an overvalued exchange rate has contributed to trade imbalances by making imports relatively cheap and exports less competitive. This approach has been supported by external borrowing rather than earning foreign exchange through exports.

Key Statistic: Pakistan’s exports as a percentage of GDP have declined from around 13% in the early 2000s to approximately 10% in recent years, while comparable countries in the region have seen significant export growth.

Recent policy shifts toward a more market-determined exchange rate have helped improve export competitiveness, but structural constraints continue to limit export growth. Addressing the trade deficit requires comprehensive reforms to enhance productivity, diversify the export base, improve the business environment, and develop stronger integration into global value chains.

Explore Pakistan’s Trade Potential

Download our analysis of export opportunities and strategies for addressing Pakistan’s trade challenges.

Poverty, Inequality, and Social Protection

Despite periods of economic growth, Pakistan has struggled with persistent poverty and inequality. Recent economic challenges, including high inflation, have reversed some of the progress made in poverty reduction over previous decades.

Poverty Trends and Dimensions

Poverty in Pakistan has multiple dimensions and varies significantly across regions:

Inequality and Social Mobility

Income and wealth inequality in Pakistan remains high, with limited opportunities for social mobility. The richest 20% of the population accounts for approximately 45% of total consumption, while the poorest 20% accounts for only 8.5%. This inequality is reflected in disparities in access to education, healthcare, and economic opportunities.

Several factors contribute to persistent inequality:

Social Protection Systems

Pakistan has developed several social protection programs to address poverty and vulnerability, though coverage and adequacy remain challenges:

Major Programs

Implementation Challenges

“Effective social protection is not just about alleviating immediate hardship but about building resilience and creating pathways out of poverty through human capital development.”

Recent economic challenges have highlighted the importance of robust social protection systems. During the COVID-19 pandemic and the 2022 floods, emergency cash transfer programs provided critical support to vulnerable households. However, sustainable poverty reduction requires addressing structural constraints to economic opportunity and social mobility.

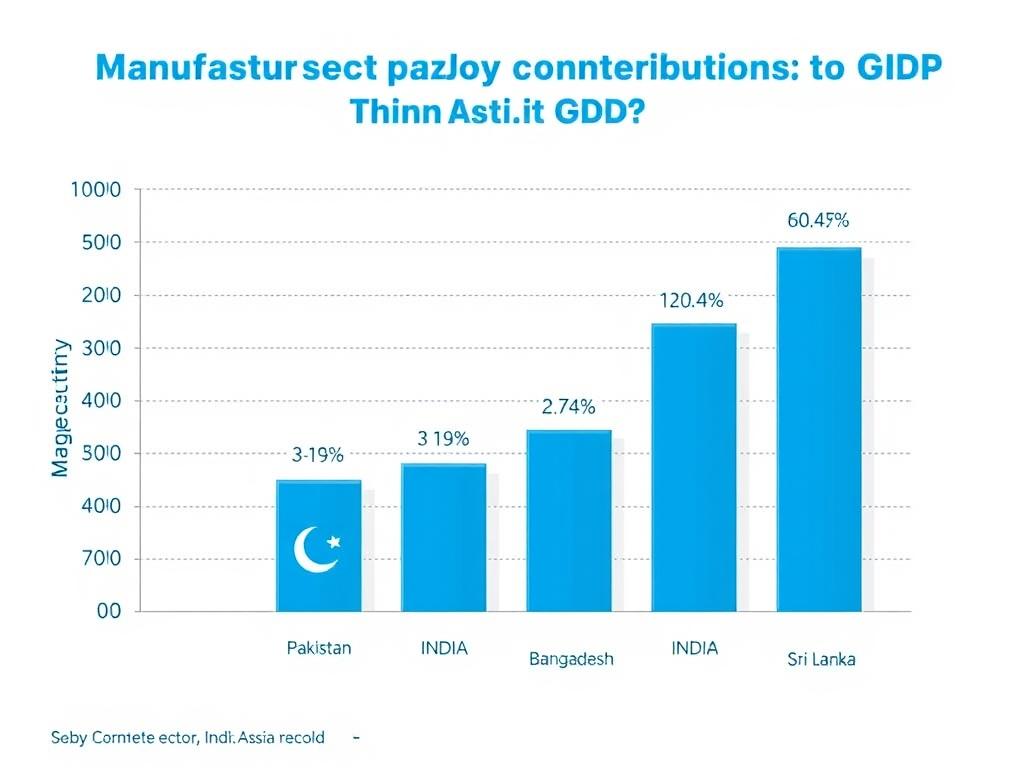

Manufacturing Sector Decline

Pakistan’s manufacturing sector has experienced relative decline over recent decades, with its contribution to GDP stagnating around 12-14%, compared to 20-30% in more successful industrializing economies. This deindustrialization has limited economic growth, job creation, and export diversification.

Structural Challenges in Manufacturing

Several factors have contributed to the underperformance of Pakistan’s manufacturing sector:

Textile Industry: Challenges in the Flagship Sector

The textile industry, Pakistan’s largest manufacturing sector and major export earner, faces significant challenges:

Internal Constraints

External Pressures

Despite these challenges, the textile sector has shown resilience and remains crucial for Pakistan’s economy. Recent policy support, including export facilitation measures and the Textile Policy 2020-25, aims to enhance competitiveness and promote value addition.

Industrial Policy and Reform Needs

Revitalizing Pakistan’s manufacturing sector requires a comprehensive industrial policy approach that addresses both cross-cutting constraints and sector-specific challenges. Key priorities include:

Key Statistic: Manufacturing value added per capita in Pakistan is approximately $180, compared to $350 in Bangladesh and $390 in India, highlighting the productivity gap that needs to be addressed.

The China-Pakistan Economic Corridor (CPEC) offers potential opportunities for industrial development through infrastructure improvements and industrial cooperation. However, realizing these benefits requires addressing the fundamental constraints facing the manufacturing sector and ensuring that new investments create linkages with the domestic economy.

Digital Economy and Future Opportunities

Despite the numerous economic challenges Pakistan faces, the digital economy presents significant opportunities for growth, job creation, and improved service delivery. The COVID-19 pandemic accelerated digital adoption, creating momentum that could be leveraged for economic transformation.

Current State of Pakistan’s Digital Economy

Pakistan’s digital landscape shows both promising developments and significant gaps:

Opportunities for Digital Transformation

Several areas offer particular promise for digital-led economic growth:

IT and Business Process Outsourcing

Financial Technology (Fintech)

Other promising areas include agricultural technology (agritech), education technology (edtech), and health technology (healthtech), all of which address critical needs in Pakistan’s economy and society.

Policy Framework and Enabling Environment

Realizing the potential of the digital economy requires a supportive policy environment. The government has taken several initiatives, including:

However, challenges remain in areas such as digital infrastructure, cybersecurity, data protection, and digital literacy. Addressing these challenges requires coordinated policy action and investment.

“Pakistan’s digital economy has the potential to create millions of jobs, boost productivity across sectors, and promote financial inclusion. Realizing this potential requires addressing infrastructure gaps, developing digital skills, and creating an enabling regulatory environment.”

The digital economy offers Pakistan an opportunity to leapfrog traditional development stages and address longstanding economic challenges. By leveraging its young population, improving connectivity, and fostering innovation, Pakistan can build a more resilient and inclusive economy for the future.

Stay Updated on Pakistan’s Economic Future

Subscribe to our newsletter for regular insights on Pakistan’s economic developments, policy changes, and emerging opportunities.

Conclusion: Pathways to Economic Recovery

Pakistan’s economic challenges are multifaceted and deeply rooted, requiring comprehensive and sustained reform efforts. The country faces a complex set of interrelated issues, from governance and fiscal constraints to structural weaknesses in key sectors. However, with appropriate policies and institutional reforms, Pakistan can chart a path toward economic stability and sustainable growth.

Several key priorities emerge from our analysis of Pakistan’s economic issues:

Recent stabilization efforts under the IMF program have helped address immediate macroeconomic imbalances, but sustainable development requires going beyond short-term fixes to address fundamental structural issues. This includes not only economic reforms but also investments in climate resilience, social protection, and digital infrastructure.

Pakistan’s young population, strategic location, and untapped potential in various sectors offer opportunities for economic transformation. By addressing the challenges outlined in this guide and building on emerging strengths, Pakistan can work toward a more prosperous and inclusive economic future.

Frequently Asked Questions

What are the main causes of Pakistan’s economic crisis?

Pakistan’s economic crisis stems from multiple interconnected factors. These include persistent fiscal deficits leading to high public debt, low tax revenue collection, heavy reliance on external borrowing, frequent balance of payment crises, energy sector inefficiencies, and governance challenges. External shocks such as the COVID-19 pandemic, global commodity price increases, and climate disasters (particularly the 2022 floods) have exacerbated these underlying structural weaknesses.

How has the IMF helped Pakistan’s economy?

The IMF has provided Pakistan with financial support through various programs, most recently a 37-month Extended Fund Facility agreed in September 2024. These programs provide liquidity support during balance of payment crises and help stabilize the economy through policy reforms. IMF programs typically require fiscal consolidation, monetary tightening to control inflation, exchange rate flexibility, and structural reforms in areas like energy and taxation. While IMF support has helped Pakistan avoid default and stabilize immediate crises, the long-term effectiveness depends on Pakistan’s implementation of sustainable economic reforms.

Why is Pakistan’s tax-to-GDP ratio so low?

Pakistan’s low tax-to-GDP ratio (around 12.5%) results from several factors: a narrow tax base with many sectors (like agriculture and retail) largely untaxed; widespread tax evasion and weak enforcement; complex tax laws with numerous exemptions and special treatments; administrative inefficiencies in tax collection; a large informal economy operating outside the tax net; and political resistance to expanding taxation. This low revenue collection severely constrains the government’s ability to invest in development priorities and provide essential services.

How has climate change affected Pakistan’s economy?

Climate change has severely impacted Pakistan’s economy through increased frequency and intensity of extreme weather events. The catastrophic floods of 2022, which caused economic losses estimated at -40 billion, are a stark example. Climate change also affects agricultural productivity through changing rainfall patterns, rising temperatures, and water scarcity. These impacts threaten food security, rural livelihoods, and export earnings. Additionally, adaptation and disaster response divert resources from development priorities, creating a challenging cycle where climate vulnerability further undermines economic stability.

What is circular debt in Pakistan’s energy sector?

Circular debt in Pakistan’s energy sector refers to a cascading chain of unpaid bills throughout the energy supply chain. It begins when distribution companies cannot collect full payment from consumers (due to theft, inefficiency, or non-payment) and therefore cannot pay power generation companies. These companies then lack funds to pay fuel suppliers, creating liquidity problems throughout the system. The government often provides subsidies and bailouts to prevent system collapse, increasing fiscal pressure. As of 2024, circular debt in the power sector had reached approximately 4% of GDP, creating operational inefficiencies and deterring investment.

Why has Pakistan’s manufacturing sector declined?

Pakistan’s manufacturing sector has declined relatively due to multiple challenges: unreliable and expensive energy supply; low investment in modern machinery and technology; skills shortages and inadequate technical training; complex regulations and high compliance costs; limited access to finance, particularly for SMEs; and intense global competition, especially in textiles. Policy inconsistency and macroeconomic instability have further undermined industrial development. Additionally, periods of exchange rate overvaluation have reduced export competitiveness while making imports relatively cheap.

How does Pakistan’s debt burden compare to other countries?

Pakistan’s public debt-to-GDP ratio (around 75%) is high but not exceptional compared to many other emerging economies. However, what makes Pakistan’s debt particularly concerning is the interest burden relative to government revenue. Interest payments consume approximately 60% of government revenue—one of the highest ratios globally. Most countries maintain this ratio below 25%. Additionally, Pakistan’s limited foreign exchange reserves relative to external debt repayments create vulnerability to external shocks and periodic liquidity crises.

What opportunities does the digital economy offer Pakistan?

The digital economy offers Pakistan significant opportunities for growth, job creation, and improved service delivery. Key areas include IT and business process outsourcing, leveraging Pakistan’s young, English-speaking workforce; financial technology (fintech) to address the needs of the large unbanked population; e-commerce to connect producers with consumers more efficiently; and digital applications in agriculture, education, and healthcare. The digital economy can help Pakistan leapfrog traditional development stages, create employment for its youth, boost productivity across sectors, and promote financial inclusion.

How has Pakistan’s population growth affected its economy?

Pakistan’s rapid population growth has significantly constrained economic development. With the population quadrupling over the past 50 years, Pakistan has a much higher dependency ratio (proportion of non-working-age to working-age population) than neighboring countries. This reduces household saving capacity, limiting funds available for investment. The large youth population also creates pressure to generate millions of new jobs annually. Additionally, rapid population growth strains public services like education and healthcare and increases competition for limited resources.

What reforms are most critical for Pakistan’s economic recovery?

Several reforms are critical for Pakistan’s economic recovery: fiscal reforms to broaden the tax base and improve revenue collection; energy sector reforms to address circular debt and improve efficiency; governance improvements to reduce corruption and strengthen institutions; trade and industrial policies to enhance export competitiveness and diversification; human capital investments in education, health, and skills development; and financial sector reforms to improve access to credit for productive sectors. Climate resilience measures and social protection systems are also essential for sustainable and inclusive growth.

Get Expert Analysis on Pakistan’s Economy

Subscribe to our newsletter for in-depth analysis, policy updates, and economic forecasts delivered to your inbox.